Fascination About Home Warranty Claim

Wiki Article

Home Warranty Claim for Beginners

Table of ContentsHome Warranty Claim Things To Know Before You BuyHome Warranty Claim - An OverviewThings about Home Warranty ClaimThe Main Principles Of Home Warranty Claim 6 Easy Facts About Home Warranty Claim DescribedHome Warranty Claim Fundamentals Explained

House insurance policy might additionally cover medical expenses for injuries that individuals endured by getting on your building. A home owner pays a yearly costs to their property owner's insurer. On standard, this is somewhere in between $300-$1,000 a year, depending upon the plan. When something is harmed by a disaster that is covered under the residence insurance plan, a house owner will call their house insurance policy business to file an insurance claim.

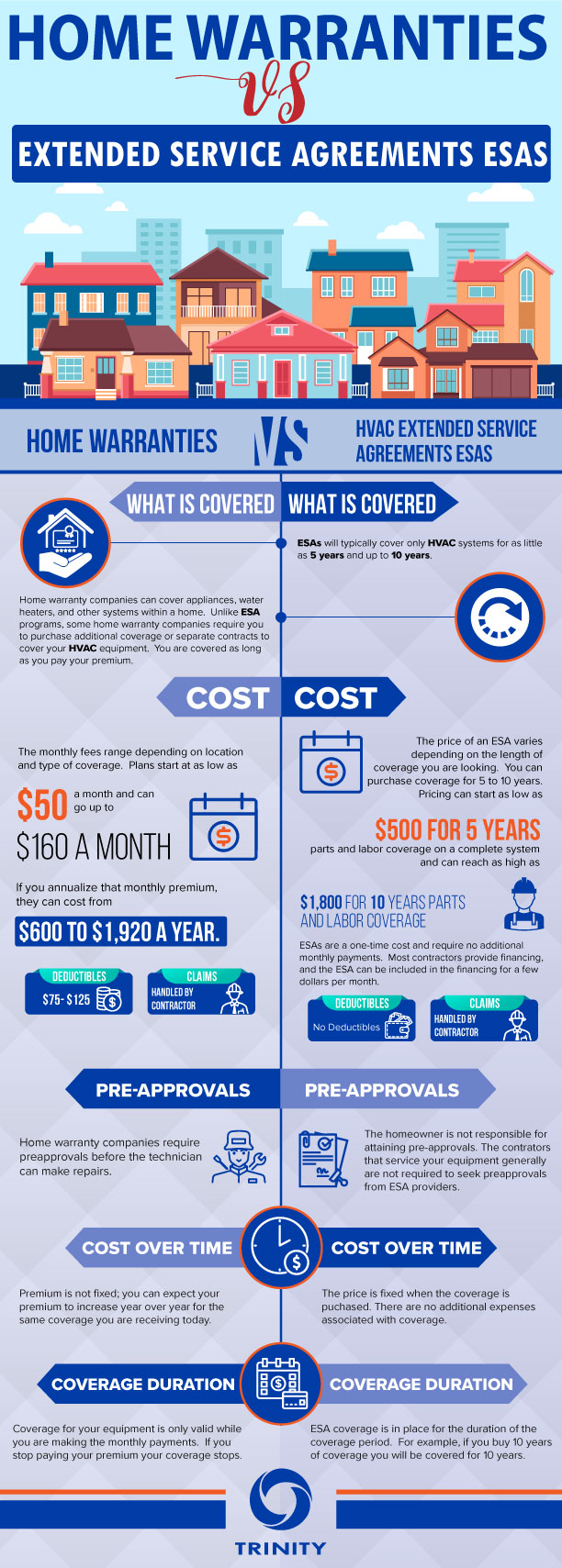

What is the Distinction Between House Service Warranty and Home Insurance Coverage A residence guarantee agreement and a home insurance plan run in comparable means. Both have a yearly premium and a deductible, although a house insurance coverage costs and also deductible is typically a lot greater than a house guarantee's (home warranty claim). The main distinctions between residence service warranties as well as home insurance policy are what they cover.

What Does Home Warranty Claim Mean?

An additional distinction between a home service warranty and also residence insurance policy is that residence insurance policy is normally required for property owners (if they have a home mortgage on their house) while a home service warranty strategy is not required. A residence service warranty as well as residence insurance coverage offer protection on various parts of a residence, as well as together they can protect a home owner's budget plan from expensive fixings when they unavoidably appear.If there is damages done to the structure of the house, the proprietor won't need to pay the high prices to fix it if they have home insurance policy. If the damage to the house's structure or house owner's belongings was caused by a malfunctioning appliances or systems, a residence warranty can aid to cover the pricey repair services or substitute if the system or home appliance has actually stopped working from regular deterioration.

They will function together to provide defense on every part of your home. If you're interested in purchasing a residence service warranty for your residence, have a look at Site's house warranty strategies and also prices right here, or request a quote for your home below.

Not known Details About Home Warranty Claim

In a warm seller's market where home buyers are waiving the house examination backup, acquiring a house warranty could be a balm for fret about potential unknowns. To get the most out of a residence warranty, it is Continued necessary to read the fine print so you recognize what's covered and also exactly how the strategy functions prior to subscribing.The difference is that a home warranty covers a series of things instead than just one. There are three conventional kinds of house guarantee plans. System plans cover your residence's mechanical systems, consisting of heating & cooling, electrical as well as pipes. Appliance plans cover major appliances, like the dishwasher, stove and cleaning machine.

The Of Home Warranty Claim

Builder warranties generally do not cover devices, though in an all new house with brand-new devices, makers' guarantees are likely still in play. If you're getting a residence service warranty for a brand-new home either brand-new building and construction or a residence that's brand-new to you coverage usually begins when you close.Simply put, if you're getting a residence and also an issue comes up throughout the residence examination or is noted in the vendor's disclosures, your residence guarantee business might not cover it. Instead than depending exclusively on a guarantee, try to negotiate with the vendor to either treat the concern or offer you a credit rating to help cover the price of having it fixed.

You don't have to study and get suggestions to find a tradesperson every time you need something taken care of. The other side of that is that you'll obtain whomever the home guarantee company sends to do the analysis as well as make the repair service. You can not choose a service provider (or do the work yourself) and after that obtain reimbursed.

Our Home Warranty Claim Statements

home insurance policy, A home guarantee is not the like property owners insurance coverage. For one, home owners insurance policy is required by loan providers in order to get a mortgage, while a house guarantee is entirely optional. However the larger distinctions remain in what they cover and also how they work. As mentioned over, a residence service warranty covers the repair service as well as replacement of things as well as systems in your house.Your home owners insurance, on the other hand, covers the unanticipated. It won't assist you change your devices because they obtained old, yet homeowners insurance coverage can aid you get new appliances if your existing ones are damaged in a fire or flood.

Just how a lot does a house guarantee expense? Residence warranties typically set you back between $300 and also $600 per year; the cost will differ depending on the type of plan you have.

The Single Strategy To Use For Home Warranty Claim

Report this wiki page